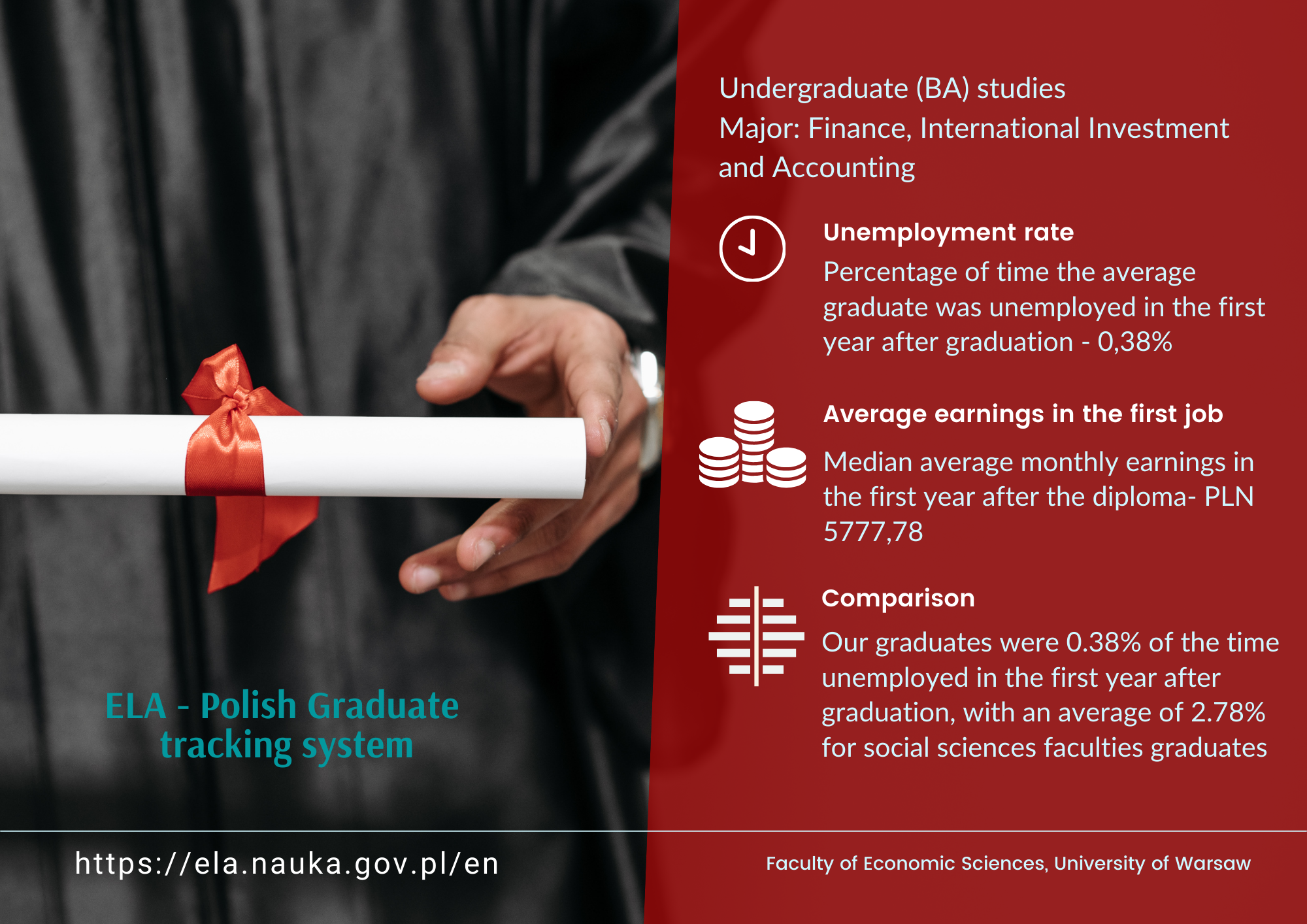

Career perspectives

Finance, International Investment, and Accounting focusses on key factors influencing international portfolio capital flows and direct investment.

We prepare our students to conduct research in the fields of open economy macroeconomics, international trade, international financial management, or international banking. During the first-cycle programme, we build on theoretical foundations and teach a variety of skills to enable you to conduct research, for instance on the analysis and determinants of exchange rates, the effectiveness of macroeconomic policy under the conditions of free capital flow, analysis of exchange rate risk management techniques, financial engineering of multinational corporations, or investment in foreign assets.

Graduates of the study programme have:

- the ability to apply their knowledge of mathematics, operations research, and statistical and econometric methods, combined with the ability to use STATA, Excel, and Maxima analytical software to carry out quantitative analysis of economic, financial and management problems;

- the ability to use microeconomic and macroeconomic theory to model socio-economic processes on the basis of the scientific method;

- knowledge of the functions of the economy, with particular emphasis on broader aspects of finance, investment, and international accounting;

- knowledge of the capital market and insurance models, as well as knowledge of modern financial instruments and valuation methods for financial instruments;

- the ability to evaluate a business and to assess the economic and financial situation of economic operators, including those in international markets;

- the ability to apply knowledge about accounting, investment, and insurance to the strategic and operational decisions of enterprises, including international entities;

- the ability to produce reports and present the results of independent analyses in a communicative manner, also in fluent English;

- the ability to plan and maintain good organisation in one’s own work as well as teamwork, the ability to learn quickly and improve one’s qualifications;

- knowledge and understanding of the need to comply with professional ethical standards.

EMPLOYMENT

Solid theoretical grounding in the functions of financial markets, insurance, corporate finance, monetary policy, and commercial banks, combined with a practical skillset, allows graduates to excel in positions where a thorough understanding of these areas is required, in particular:

Banking

- Strategist

- AML Operations Analyst (Anti-Money-Laundering)

- Retail/mobile/development/cooperative banking analyst

- Consumer Finance

Financial services

- Investment analyst

- Risk analyst

- Financial analyst

- Trading specialist

- Auditor

- Accountant

Consultancy services

- Tax advisor

- Transaction advisor

- Credit risk management